Social Security Number

What is a Social Security Number?

A Social Security Number (SSN) is a unique nine-digit identification number assigned to individuals by the U.S. government for tax and other purposes. The primary purpose of an SSN is to track an individual's earnings and their contributions to the Social Security system, which is a federal program.

In addition to its use in the Social Security system, an SSN is required for employment, and often for banking and credit purposes. Many government agencies, including the Internal Revenue Service (IRS), also use SSNs as a means of identifying individuals for tax reporting purposes.

What is a Social Security Card?

A social security card is required to work in the United States. On the card is a unique 9-digit Social Security Number (SSN) issued by the U.S. Social Security Administration (SSA). The card (and your SSN) will be necessary to work in the U.S. and to file taxes. A social security card is NOT a work permit.

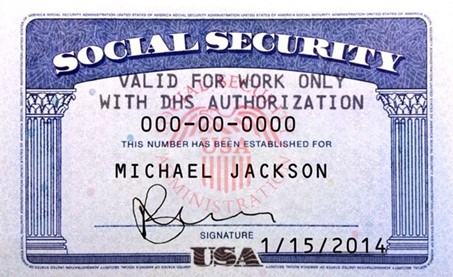

Example SS card:

Who is eligible for a Social Security Number?

Only students or scholars in active immigration status. If your SEVIS record is not “active," the Social Security Administration will not be able to verify your status.

IMPORTANT: Newly arrived F-1 and J-1 students must wait until they have entered the U.S., enrolled in classes at IWU, and completed the check-in process with the International Office before applying for an SSN. The International Office cannot update your SEVIS record to "active" until after you have both enrolled in classes AND completed the required immigration check-in with the International Office.

Students and scholars in active immigration status in the following situations may apply for an SSN:

- F-1 students with a job offer letter

- F-1 students with approved CPT or OPT work authorization

- J-1 students with a job offer and written work permission from their DS-2019 sponsor

- For J-1 students on exchange at IWU, your sponsor letter must come from the International Office.

- J-1 visiting scholars

- J-2 dependents with work permission from USCIS (EAD)

- H-1B & O-1 visa holders

- Individuals with other types of immigration status allowing employment

Note: F-2 dependents are not eligible for Social Security Numbers.

Learn how to apply for an SSN

Keep your SSN secure

Your SSN is sensitive, personal identification information. It is important to keep it safe and out of the hands of scammers who wish to use it to utilize your identity or credit history.

- Do not carry your Social Security Card with you unless you need it for a specific purpose.

- Memorize your SSN for times you will need it.

- Do not type or write your SSN in the body of an email or text message.

- Do not send your SSN or image of your Social Security Card as an email attachment.

- Be careful sharing your SSN by email, text, voicemail, and fax.

- For example, your SSN could get intercepted and read after you send your information. There are sometimes ways to help keep your information safe — for instance, by using a VPN on an unprotected Wi-Fi network. But the safest way to share may be face to face with someone you know and trust.

- The International Office does not need a copy of your Social Security Card and will not ask you for your SSN.

- When an employer is setting up payroll and tax paperwork at a new job.

- When setting up a new bank account, opening a credit card, or applying for a loan.

- When a business needs to check your credit in order to apply for an apartment, sign up for utilities, or get a contract-based mobile phone plan.

Call the Federal Trade Commission at 877-438-4338, or file a report with the agency online. You can also reach the fraud hotline for the Social Security Administration’s Office of the Inspector General at 800-269-0271, or submit a report to the SSA Inspector General office online.

The Social Security Administration offers the ability to block electronic access to your number. It could be a good option if you need to lock down your account following a fraud incident. Call 800-772-1213 to request a block.

Additional Resources

Social Security Administration - official website

International Students and Social Security Numbers - SSA publication

Foreign Workers and Social Security Numbers - SSA publication

Identity Theft and your Social Security Number - SSA publication

What to know about identity theft - from the Federal Trade Commission (FTC)

Need assistance?

If you have any trouble obtaining the SSN, please ask to know the name of the person helping you and for a letter from the Social Security Office detailing the reason of the problem. Next, please the International Office with this information as well as your SSN application number.